Executive Summary

| Regulation | Content | Date |

| Law N° 7228 | The 2024 budget ceilings are established for the National Directorate of Tax Revenues ("DNIT") to credit amounts for undue or excess payments, interest and surcharges. | December 29, 2023 |

| Law N° 7228 | DNIT's budget allocation for fiscal year 2024. | December 29, 2023 |

| Decree N° 1184 | The organizational and functional structure of the DNIT. | February 15, 2024 |

| Binding Consultation | The DNIT ruled on the tax treatment to be given to the sale and purchase of goods located abroad between two companies domiciled in Paraguay. | October 2023 |

More Information:

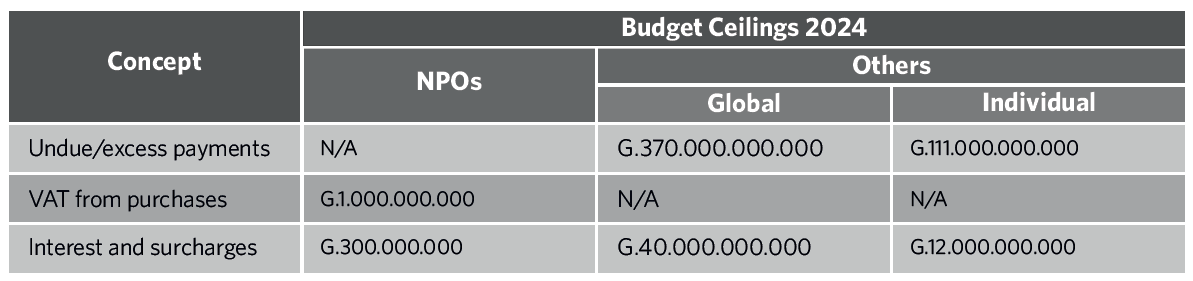

► Law N° 7228/2023 —The 2024 budget ceilings are established for the DNIT to credit amounts for undue or excess payment, interest and surcharges.

Law No. 7228/2023 approved the General Budget of the Nation ("PGN") for fiscal year 2024 and established several tax measures that, to a greater or lesser extent, affect taxpayers. One of these measures is the annual budget ceilings for crediting taxpayers the balances due to them for:

- undue or excess payment, refund of value-added tax ("VAT") from purchases made by non-profit entities ("NPOs"), and

- for accessories in the following tax credit recovery processes:

- VAT refund (exporters, export freight forwarders, Yacyretá suppliers, etc.),

- repetition due to undue or excess payment and

- refund of VAT purchased from the ESFLs.

This budgetary measure has been implemented every year since Law No. 5061/2013 (see Article 7) and Decree No. 850/2013. For this fiscal year 2024, the overall and individual (per taxpayer) budget ceilings are the same as for fiscal year 2023:

The global limits represent the maximum amount that DNIT can credit in the indicated concepts during the entire fiscal year 2024, while the individual limits per taxpayer are 30% of the global limit for each concept. This means that no taxpayer may represent a higher percentage of credits than indicated, thus avoiding the situation where only one taxpayer excludes the others.

These budget limits do not apply to VAT refunds to ESFLs as a result of court rulings, as these have their own limits. In addition, the way in which this item is credited to ESFLs also differs from the normal regime, as these amounts are paid in cash and not credited to the taxpayer's tax account, as is the case in other instances.

If the total budget limits are reached during the fiscal year, the amounts pending credit are deferred to the following fiscal year without generating legal accessories. The area responsible for making the credits must correlatively record the resolutions that provide for them, for inclusion in the PGN for the following fiscal year.

► Law No. 7228/2023 - The DNIT budget allocation for fiscal year 2024.

With the approval of the PGN 2024, through Law No. 7228/2023, the DNIT received its budget allocation for that fiscal year. This is also the first budget allocation for the institution since its creation in August 2023, when the former Undersecretariat of State for Taxation ("SET") and the National Customs Directorate ("DNA") were merged.

The DNIT's estimated income for 2024 is G. 990,777,629,187, of which only G.675,694,611,732 (68%, and approx. USD 92.8 million) will be destined for its institutional expenses (this would be its real budget), since G.315,083,017,455 (22%) is a transfer or "contribution" from said institution to the General Treasury, administered by the Ministry of Economy and Finance.

Seen from the point of view of the areas of actions assigned to DNIT, its available budget of G.675,694,611,732 is distributed as follows:

| Activity | Amount | % |

| Administering the internal tax system | G.293.656.247.044 | 44% |

| Institutional administrative management | G.135.911.001.821 | 20% |

| Collection management | G.24.966.990.225 | 4% |

| Controls in secondary zone | G.14.418.633.645 | 2% |

| Controls in primary zone | G.35.454.324.981 | 5% |

| Customs clearance process | G.171.287.414.016 | 25% |

| G.675.694.611.732 | 100% |

Of the resources DNIT has, G.548,905,501,197 (81%) are destined for current expenses and G.125,789,110,535 (19%) for capital expenses. Within current expenses, G.332,491,204,609 (49% of DNIT's actual budget) are allocated to Group 100, Personal Services Expenses (salaries, Christmas bonus, overtime, subsidies, bonuses, etc.).

It is important to highlight that the most significant individual expenditure items correspond to capital expenditures for investments in technology or expenses for its maintenance (Objects of Expenditure 261, 543 and 579), which represent an expenditure of G.108,247,101,103 (16% of DNIT's actual budget).

As a result of the above, the first allocation of the DNIT budget is marked by a strong expenditure on its personnel and information technology, which is consistent with the institutional discourse of betting on its human team and technological equipment.

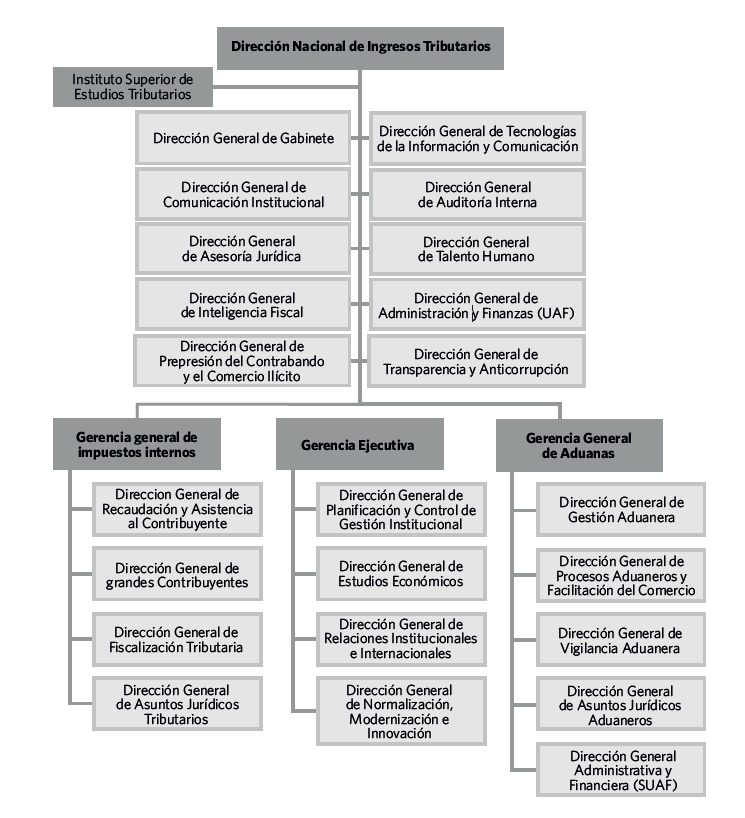

► Decree N° 1184/2024 - The organizational and functional structure of the DNIT.

By Decree No. 1184/2024, the Executive Power approved the organizational and functional structure of the DNIT and its divisions, including the 10 General Directorates and the 3 General Managements that report directly to the National Directorate. In this regard, the following diagram (in Spanish) shows the structure of the DNIT:

Among the main changes that can be observed as opposed to the former SET, it can be noted that the now Internal Taxes General Management will have 4 General Directorates out of the 7 that made up the former SET (2 of them became directly dependent of the National Directorate as of Decree No. 82/2013). It is worth mentioning that the former Directorate of Taxpayer Assistance and Tax Credits, as well as the General Directorate of Collection and Regional Offices, have been merged into the General Directorate of Collection and Taxpayer Assistance. Likewise, the former Directorate of Technique and Tax Planning has been renamed the General Directorate of Tax Legal Affairs.

As for the Customs General Management, it will be made up of six of the ten General Directorates that made up the former DNA (3 of them became directly dependent of the National Directorate as from Decree No. 82/2013). On the other hand, the Executive Management will be integrated by 4 General Directorates, which will have among their functions the development of the policies of the DNIT, the representation of the tax administration before international organizations, as well as the collaboration with them in matters of agreements, among others.

Regarding the decree in general, it is worth mentioning that, although it establishes the functions of each of the General Directorates, both those that report directly to the National Directorate and the General Managements, it does not clarify the details of the departments and coordinations that will be part of them, regardless of whether such General Directorates remained unchanged, underwent changes in their functions or were created with this decree. This will likely be regulated by means of a resolution of the DNIT.

► Answer to binding consultation on the tax treatment regarding the transfer of assets located abroad between two companies domiciled in Paraguay.

In response to a binding query during October 2023, the DNIT set forth its position on the tax treatment to be given to the transfer of assets located abroad when such a transaction is carried out by two companies domiciled in Paraguay.

In the consultation filed by the taxpayer, it mentioned that it is a company incorporated and domiciled in the country that is a representative of a Japanese company engaged in the field of engines and spare parts for boats and that it sells such goods to another company also incorporated in Paraguay, for the construction of a ship in Malaysia. In this regard, it was asked whether such purchase and sale transactions and the subsequent delivery of the goods within the national territory are subject to VAT and whether the corresponding invoice should be issued as exempt of this tax.

In this regard, the DNIT concluded that considering that the goods are not in Paraguayan territory when the transactions is carried out, the operation is not subject to VAT since it does not comply with the principle of territoriality necessary for the tax obligation to be born. However, when the vessel assembled abroad incorporates the mentioned goods and is imported to Paraguay, the taxes must be paid for such import, including VAT.