Executive Summary

The Executive Branch issued Decrees No. 2063/2024 and 2167/2024 (both, collectively, the "PTR Decree"), whereby it established the Purchasing Tourism Regime ("PTR" or “Regime”) for the settlement of the Value Added Tax ("VAT") on the importation and commercialization of certain goods intended for tourists ("PTR Goods"), and abrogated the previous tourism regime set forth in Decree No. 1931/2019, which it updates and replaces.

More information:

The PTR applies to the importation and commercialization of PTR Goods that are classified under one of the 485 tariff codes identified in the Annex to the PTR Decree, prepared based on the Mercosur Common Nomenclature ("MCN") and which have the following structure:

- Subjects of the PTR

The PTR Decree distinguishes between the following parties involved in the Regime:

- Tourists: Final recipients of the PTR Goods who meet the following requirements: (i) natural person, (ii) foreigner (not having Paraguayan nationality), (iii) not having domicile in the country (iv) nor residence in Paraguay.

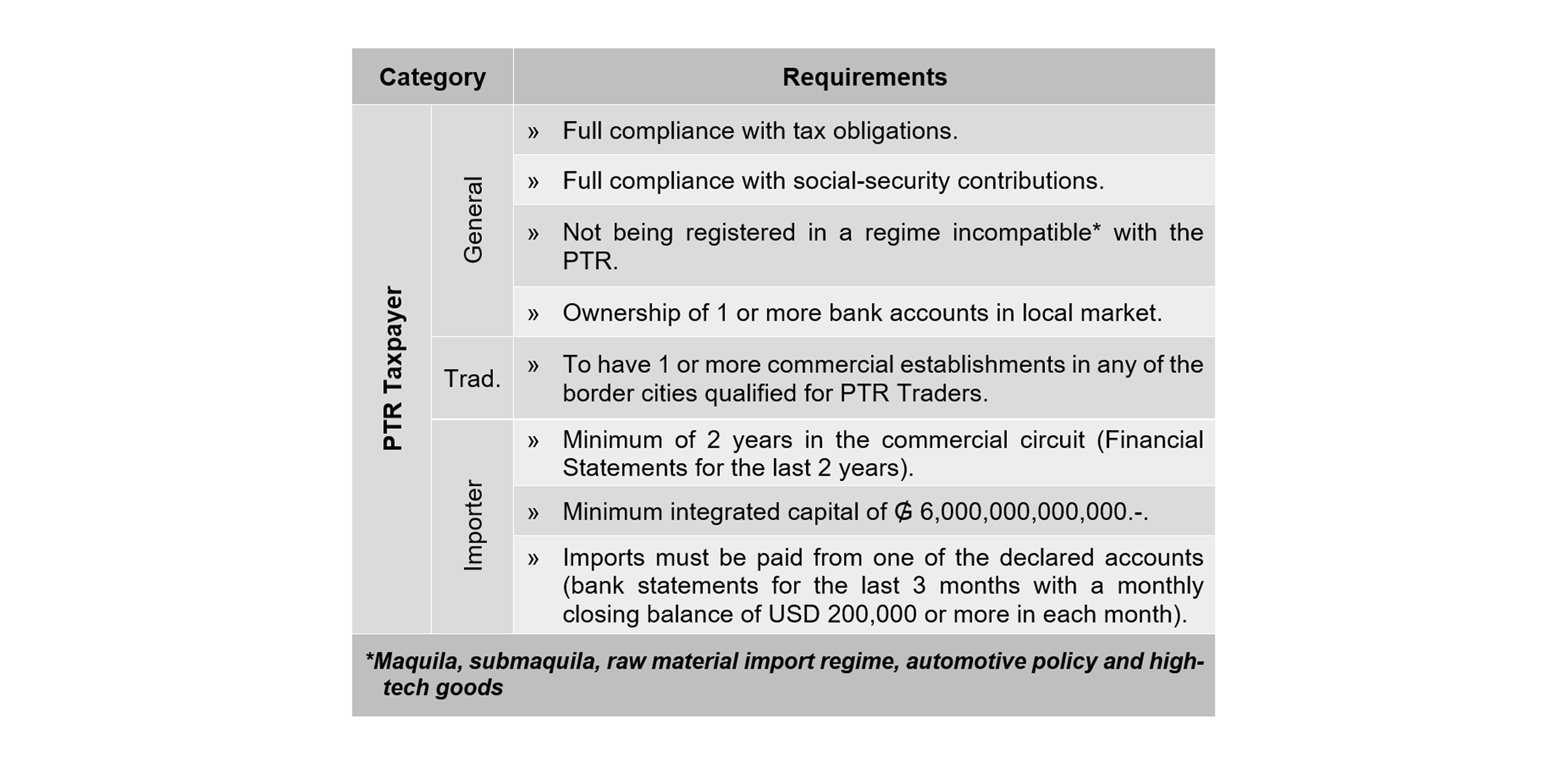

- PTR Taxpayers: Individual Limited Liability Companies, Simplified Joint Stock Companies, any type of commercial company created or admitted by law, and branches, agencies or permanent establishments of persons domiciled, or entities incorporated abroad, engaged in the commercialization of PTR Goods. According to their intervention in the Regime, they are subdivided into the following categories, without prejudice of meeting both qualities:

- PTR Importers: Those who import and sell PTR Goods to other PTR Taxpayers.

- PTR Traders: Those who sell PTR Goods to Tourists or to third parties who are neither Tourists nor PTR Taxpayers ("Third Parties").

- Foreign Trade Intermediary Companies: Trading companies and other companies engaged in the industry that are (i) taxpayers of the Corporate Income Tax ("IRE") registered with the DNIT, (ii) trade in goods and products supplied mostly by third parties, and (iii) use international networks or infrastructure to supply themselves or their customers ("EICE").

PTR Taxpayers may only sell PTR Goods to Tourists in the following border cities of Paraguay: Asunción, Ciudad del Este, Encarnación, Pedro Juan Caballero, Pilar and Salto del Guairá; for which purpose they must have premises located there. This shall not limit the operations of the PTR Importers, who may operate as such in any city of the country.

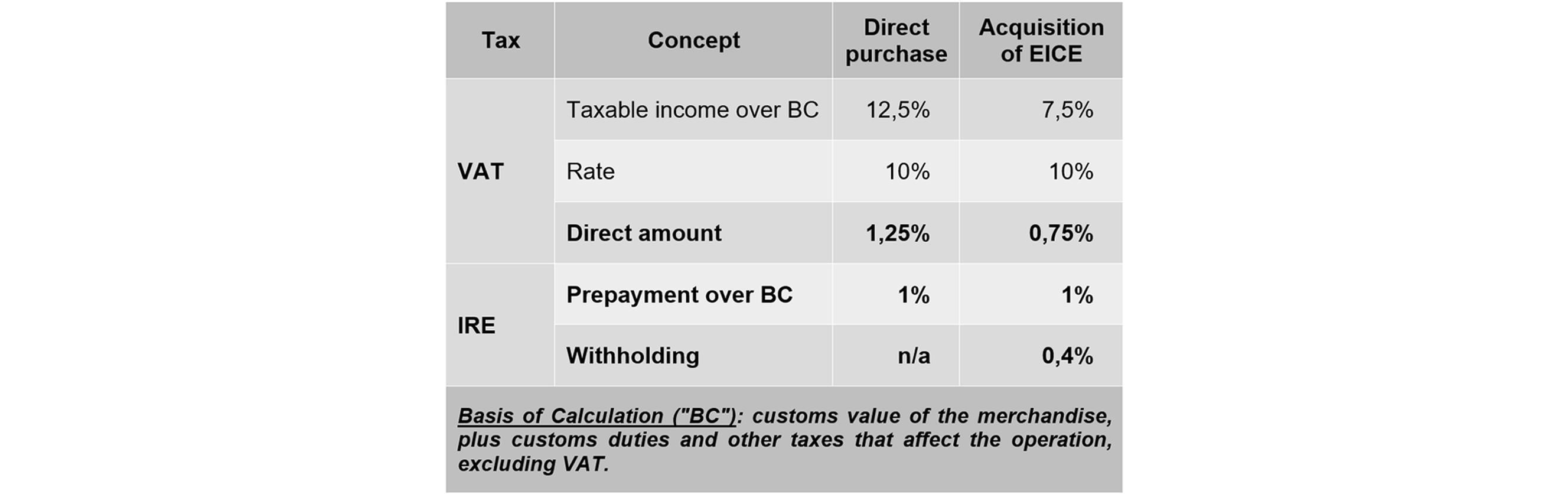

- VAT regime

Under the Regime, if the PTR Goods are not sold to Third Parties, the VAT is settled and paid only at the time of their importation at the expense of the PTR Importer, after their introduction into the country by such party, a third party, or an EICE that sold them to the PTR Importer before the formalization of the customs clearance. To remove the PTR Goods from the customs area, the PTR Importer must have complied with the following tax obligations:

The VAT and the prepayment of the IRE must be paid before the General Customs Management ("GGA") of the DNIT, while the IRE withholding must be made by the PTR Importer to the EICE on the price that the latter fills in the VAT exempt box in the invoice issued to the PTR Importer. The taxation of the acquisition of the EICE will not be applicable if the EICE and the PTR Importer are related parties under transfer pricing rules, being applicable, instead, the normal taxation of transfer in customs area (VAT exempt) and of direct purchase by the PTR Importer.

The PTR Taxpayer who sells the PTR Goods to Tourists or other PTR Taxpayers will do so exempt from VAT and will support these operations with the invoices in which the identification of the purchaser must be stated (they cannot be unnamed) and, in the case of Tourists, their country of residence. In these cases, the VAT paid by the PTR Importer to the GGA will constitute a single and definitive payment, as well as a deductible expense of the IRE, since it is related to a VAT-exempt sale. Sales to Tourists will not give the right to VAT refunds.

If the PTR Taxpayer sells the PTR Goods to Third Parties or documents the operation with an unnamed invoice, the PTR Taxpayer must invoice the corresponding VAT under the general settlement system of this tax. In these cases, if the PTR Importer is the one who has made the sale, the VAT paid by him to the GGA will constitute a VAT credit, in accordance with the settlement rules of this tax.

If the DNIT detects that a PTR Taxpayer invoiced the sale of PTR Goods to Third Parties as VAT exempt or in an unnamed form, it will revalue the amount of the tax according to the general regime and apply penalties.

- Other incentives

In addition to the reduced VAT, the PTR Decree also establishes other incentives for the Regime in terms of costs for copyrights and related rights, as well as for the importation of hazardous cargo by air transport.

With respect to copyright and related rights costs, the amount of the Compensatory Remuneration Right for Private Copying is halved. This is the economic compensation granted to authors, composers, artists, performers and producers of phonograms or videograms, for the unauthorized copying of their works. Thus, in the PTR, this compensation goes from 0.5% to 0.25%, since it is calculated only on 50% of the value of the entry into the national territory of the products and devices subject to its payment.

With regards to the importation of hazardous cargo by air, a reduction of one point seven percentage points (1.7 pp) in the handling service fees of the National Directorate of Civil Aeronautics ("DINAC") is foreseen, according to the following:

For the DINAC’s rates reduction, the PTR Importer must present the Certificate of Insurance of the respective cargo, which must contain the following information: (i) date of issue, (ii) certificate number, (iii) QR code for verification of validity, (iv) name of the consignee, (v) Policy number, (vi) Air Waybill number, (vii) weight in kilograms, (viii) origin and destination, (ix) coverage and (x) total amount insured. Upon presentation of such insurance certificate, it shall become part of the importer's declaration in detail.

Customs authorization for the transit of hazardous cargo will be granted once the PTR Importer has the Certificate of Insurance, the invoices of origin and the verification report of such certificate issued by the Customs Administration. Once the transit is authorized, DINAC will charge a 2% fee on the total FOB value of the cargo, according to the documentation presented. In all other cases, the rules outline in the regulations in force shall apply.

- Registration in the PTR

To benefit from the PTR, both the EICE and the PTR Taxpayers must enroll in the registry set up by the DNIT, specifically with the General Internal Revenue Service, without prejudice to the importers, in such capacity, to do so concomitantly with the GGA.

The documentary requirements established to obtain authorization in the PTR must be maintained during the entire term of its validity. In the case of the registration of the EICE, they will be established by resolution of the DNIT, while those for the registration of the PTR Taxpayers are as follows:

If the PTR Taxpayer or whoever wishes to register as such is the holder of more than one domestic or foreign bank account, he/she must identify each one of them in the registry, attach the respective bank statements and indicate those accounts through which the payment transactions shall be made. Any variation or modification to the information of the registry must be communicated to the DNIT within 10 working days.

The qualification as a PTR Taxpayer will have a duration of two (2) calendar years, provided that the DNIT does not revoke it. Renewal will be made at the request of the interested party, for the same term, provided that the requirements for registration are met and the PTR Taxpayer has demonstrated cooperative behavior with the authorities e.

The DNIT will revoke the PTR Taxpayer's qualification when it: (i) fails to comply with any of the requirements established for its qualification or other obligations; (ii) commits smuggling or fraud according to Law No. 2422/2004, "Customs Code"; or (iii) sells the PTR Goods in with unnamed invoice. This revocation will cause the disqualification to operate in the PTR for 2 years from its notification.

- Obligations and limitations

The PTR Taxpayers will be obliged to have an External Tax Audit as from the fiscal year in which they have registered to the Regime, regardless of the amount of their annual turnover. They must also individualize in their inventory the PTR Goods and cooperate with the controls and inspections carried out by the DNIT.

In addition, the PTR Taxpayer cannot incorporate the PTR Goods as capital goods. In case of violating this prohibition, in addition to the penalties that the DNIT may apply, the DNIT will revalue and determine the VAT according to the general regime.

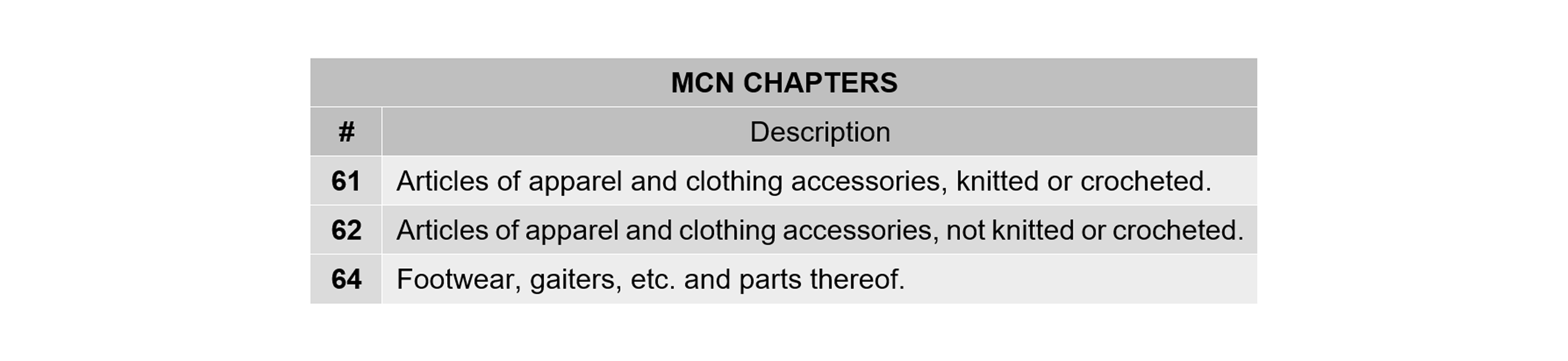

The PTR Goods identified in the following chapters of the MCN can only be sold to Tourists directly by PTR Importers, not by PTR Traders, which means that they may only be sold once under the PTR Regime, and not several times, as would be the case if they could be sold between PTR Taxpayers:

In these cases, PTR Importers must comply with the following special obligations: (i) submit an inventory of the initial stock of goods included in those chapters of the MCN at the time of requesting their qualification before the DNIT; and (ii) submit a detail of the sales made every quarter. Failure to comply with the latter will lead to suspension in the PTR until regularization.

- Validity of the PTR

El Decreto RTC fue publicado en la Gaceta Oficial N° 134 del 9 de julio de 2024, por lo que entró a regir desde el día siguiente, a pesar de la corrección publicada en la Gaceta Oficial N° 146 del 24 de julio de 2024. Las habilitaciones otorgadas para operar bajo el anterior régimen de turismo del Decreto N° 1931/2019, por lo tanto, estuvieron vigentes hasta el mes de agosto de 2024. No obstante, los bienes ingresados al inventario de los Contribuyentes RTC bajo el anterior régimen de turismo deberán ser enajenados conforme con las reglas vigentes al momento de su adquisición.

Finally, if you wish to consult the list of goods included in the PTR established in the annex to the PTR Decree, you may do so by entering here.